15 Essential Expense Categories

Table of Contents

- 1. Housing Expenses

- 2. Utilities

- 3. Groceries and Household Supplies

- 4. Transportation Costs

- 5. Healthcare Expenses

- 6. Insurance Premiums

- 7. Debt Repayment

- 8. Savings and Investments

- 9. Personal Care and Clothing

- 10. Entertainment and Recreation

- 11. Education and Training

- 12. Childcare and Education

- 13. Miscellaneous Expenses

- 14. Technology and Communication

- 15. Personal Development and Hobbies

- Strategies for Cutting Down on Daily Expenses

- Balancing Leisure Activities and Budgetary Constraints

- Conclusion

Navigating personal and household budgeting demands a strategic and comprehensive approach. In this guide, we'll delve into 15 crucial expense categories, offering insights and practical examples to help you build a robust financial plan.

1. Housing Expenses

Housing expenses, including rent or mortgage payments, property taxes, homeowners' insurance, and maintenance costs, constitute a significant portion of your budget. Ideally, aim to allocate no more than 25-30% of your income towards housing.

Break it down further by assigning 1-2% for property taxes, 0.25-0.5% for homeowners' insurance, and setting aside 1-3% for maintenance costs to cover repairs and general upkeep.

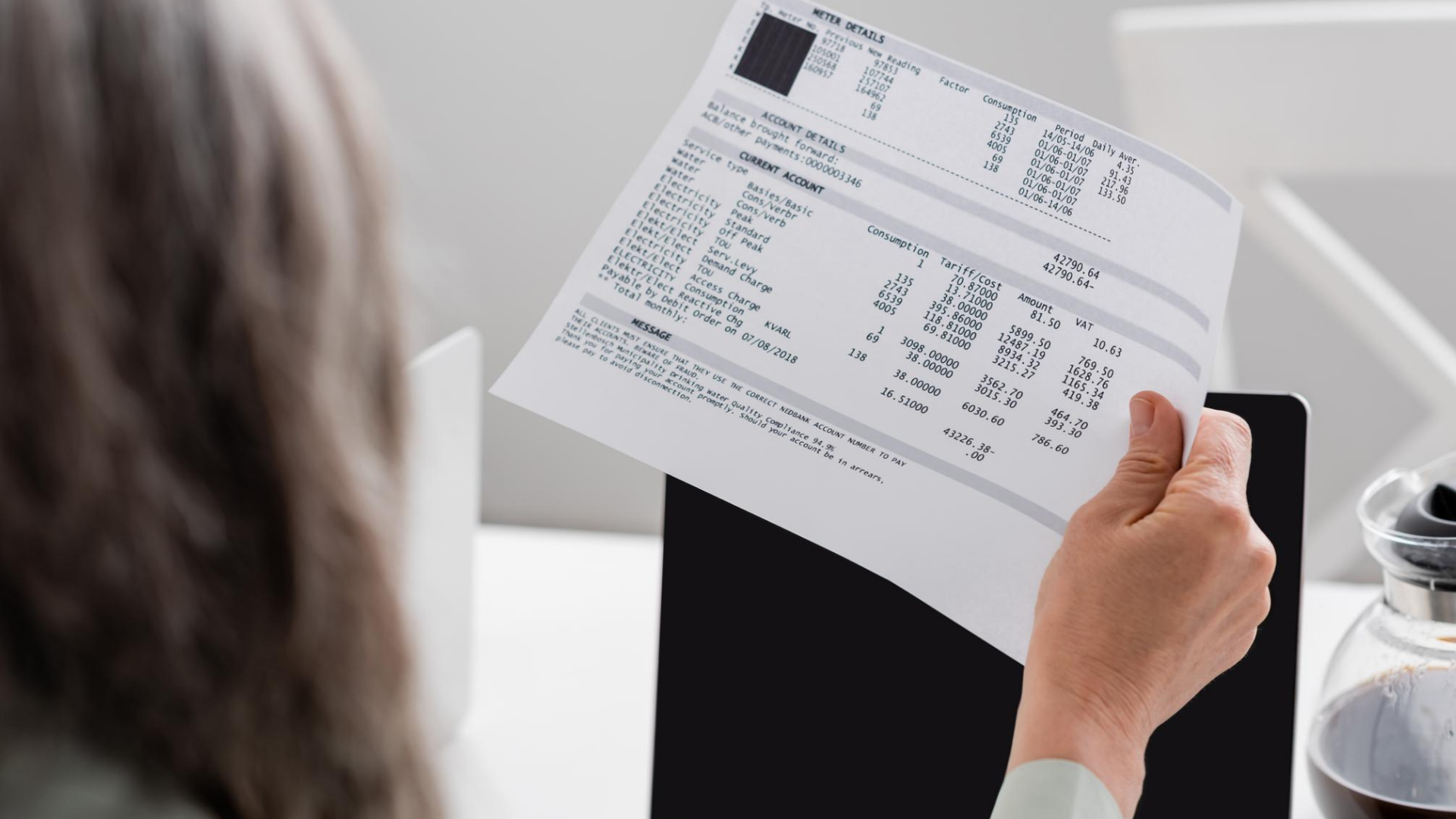

2. Utilities

Managing utility costs involves tracking electricity, water, gas, and internet expenses. A well-balanced budget designates approximately 5% for electricity, 2-4% for water, 2-3% for gas, and 1-2% for internet services.

Regularly monitoring and optimizing your energy consumption can help keep these costs within the recommended budget percentages.

3. Groceries and Household Supplies

Budgeting for groceries and household essentials is crucial for maintaining financial balance. Allocate 10-15% of your monthly budget for groceries and an additional 2-4% for toiletries and cleaning supplies. Creating meal plans and taking advantage of discounts can contribute to keeping these costs manageable.

4. Transportation Costs

Transportation costs cover fuel, maintenance, and insurance. To maintain a well-rounded budget, allocate 5-10% for fuel, 2-4% for maintenance, and 1-2% for insurance. Consider exploring alternative transportation methods or carpooling to optimize costs within these designated percentages.

5. Healthcare Expenses

Health is wealth, and budgeting for healthcare expenses is essential. Aim to allocate 5-7% of your monthly budget for insurance premiums and an additional 2-3% for co-pays and prescriptions. Prioritize health without compromising financial stability by exploring cost-effective insurance plans.

6. Insurance Premiums

Beyond health insurance, account for other insurance types such as life, auto, and renters' insurance. Allocate 1-2% of your annual income for life insurance, 2-3% for auto insurance, and about 1% for renters' insurance. Regularly review your coverage to ensure it aligns with your needs while staying within budgetary constraints.

7. Debt Repayment

Addressing debts is crucial for financial health. Devote at least 20% of your budget to paying off high-interest debts. Prioritize these payments to free up financial resources for other essential categories in the long run.

8. Savings and Investments

Building a financial safety net is paramount. Aim to set aside 3-6 months' worth of living expenses in an emergency fund. For retirement, allocate 10-15% of your income to ensure a secure financial future.

9. Personal Care and Clothing

Personal care and clothing expenses can be managed effectively within a budget. Allocate 2-4% for personal care items and 3-5% for clothing. Being mindful of impulse purchases and focusing on necessities can contribute to maintaining a balanced budget in these categories.

10. Entertainment and Recreation

Leisure activities are essential for a well-rounded life. Allocate 5-10% of your budget for entertainment and recreational activities. Look for budget-friendly alternatives to enjoy your free time without straining your finances.

11. Education and Training

If you're pursuing education or training, allocate 2-3% of your budget for tuition, books, and associated costs. Explore scholarships, grants, or employer reimbursement programs to alleviate the financial burden of furthering your education.

12. Childcare and Education

For parents, budgeting for childcare expenses, school fees, and extracurricular activities is crucial. Aim for 7-10% for childcare and allocate an additional 2-5% for education-related costs to ensure your children's well-being and academic development.

13. Miscellaneous Expenses

Unforeseen expenses are a part of life. Maintain a buffer in your budget, allocating 5-10% for miscellaneous expenses. This can cover unexpected home repairs, medical emergencies, or any unforeseen financial challenges that may arise.

14. Technology and Communication

Stay connected without breaking the bank by allocating 1-2% of your budget for phone bills and a similar percentage for internet services. Regularly review your plans to ensure they align with your needs and explore cost-effective alternatives.

15. Personal Development and Hobbies

Personal growth and hobbies contribute to a fulfilling life. Allocate 2-4% of your budget for personal development and hobbies. Whether it's taking courses, attending workshops, or pursuing personal interests, incorporating these into your budget ensures a well-balanced and enriching lifestyle. Regularly assess your priorities to align this category with your evolving interests and goals.

Strategies for Cutting Down on Daily Expenses

- Mindful Spending Habits: Developing mindfulness around your daily spending habits is a powerful strategy for cutting down on unnecessary expenses. Start by identifying areas where you tend to overspend impulsively. This could be daily coffee runs, frequent online purchases, or dining out regularly. Once identified, set realistic spending limits for these categories and actively track your expenditures.

Consider using budgeting apps that provide real-time insights into your spending patterns, helping you stay on course and make informed decisions.

- Budget-Friendly Meal Planning: One of the most impactful areas to save money daily is through meal planning. Eating out or ordering takeout regularly can significantly contribute to inflated expenses. Plan your meals for the week, create a shopping list based on your menu, and buy groceries in bulk to save on costs.

Cooking at home not only allows you to control ingredients for healthier options but also helps cut down on the expenses associated with dining outside. Consider exploring affordable yet nutritious recipes to make your meal planning both cost-effective and enjoyable.

- Embracing Minimalism: Embracing a minimalist lifestyle can be a transformative approach to cutting down daily expenses. Evaluate your possessions and identify items that no longer serve a purpose.

Selling or donating these items not only declutters your space but can also provide additional income. Before making new purchases, ask yourself if the item is a necessity or a fleeting desire.

Adopting a mindset of intentional and mindful consumption helps you prioritize what truly adds value to your life, curbing impulsive spending and contributing to long-term financial stability.

Balancing Leisure Activities and Budgetary Constraints

Finding Affordable Alternatives:

Enjoying leisure activities doesn't have to break the bank. Look for cost-effective alternatives that align with your interests. Instead of expensive outings, explore local parks, organize picnics, or engage in community events.

Many cities offer free or low-cost cultural activities, outdoor concerts, and festivals. Embracing these options not only provides an enjoyable experience but also helps you stay within your budget.

Establishing a Leisure Budget:

Create a dedicated budget for leisure activities to ensure you allocate a reasonable amount without compromising your overall financial plan. Prioritize activities that bring you the most joy, and allocate funds accordingly. Additionally, consider seeking out discounts, memberships, or subscription services that offer value for money in the long run.

By consciously planning and budgeting for leisure, you can strike a balance between enjoying recreational pursuits and maintaining financial discipline.

Conclusion

Balancing these budgeting categories requires thoughtful consideration and periodic adjustments. By aligning your spending with these guidelines, you can achieve financial stability and work towards your financial goals. Remember, flexibility is key; adapt your budget as life circumstances evolve, ensuring your financial plan remains a powerful tool for your long-term success.