8 Reasons Why Your Budget Is Failing and How to Fix It

Table of Contents

Managing personal finances is a balancing act that requires discipline, strategic planning, and the ability to adapt to life's unexpected twists and turns. One powerful tool in your financial toolkit is a well-crafted budget.

However, despite your best intentions, you might find your budget falling short of expectations.

In this comprehensive guide, we'll explore eight common reasons why budgets fail and provide actionable solutions to get your financial plan back on track.

Undefined Financial Goals

A budget without clear financial goals is like a ship without a destination. Without specific objectives, it's challenging to allocate your resources effectively.

Define short-term and long-term financial goals. Whether it's saving for a vacation , an emergency fund , or retirement, having concrete targets provides direction to your budget. Break down larger goals into smaller, achievable milestones for better tracking.

2. Inaccurate Expense Tracking

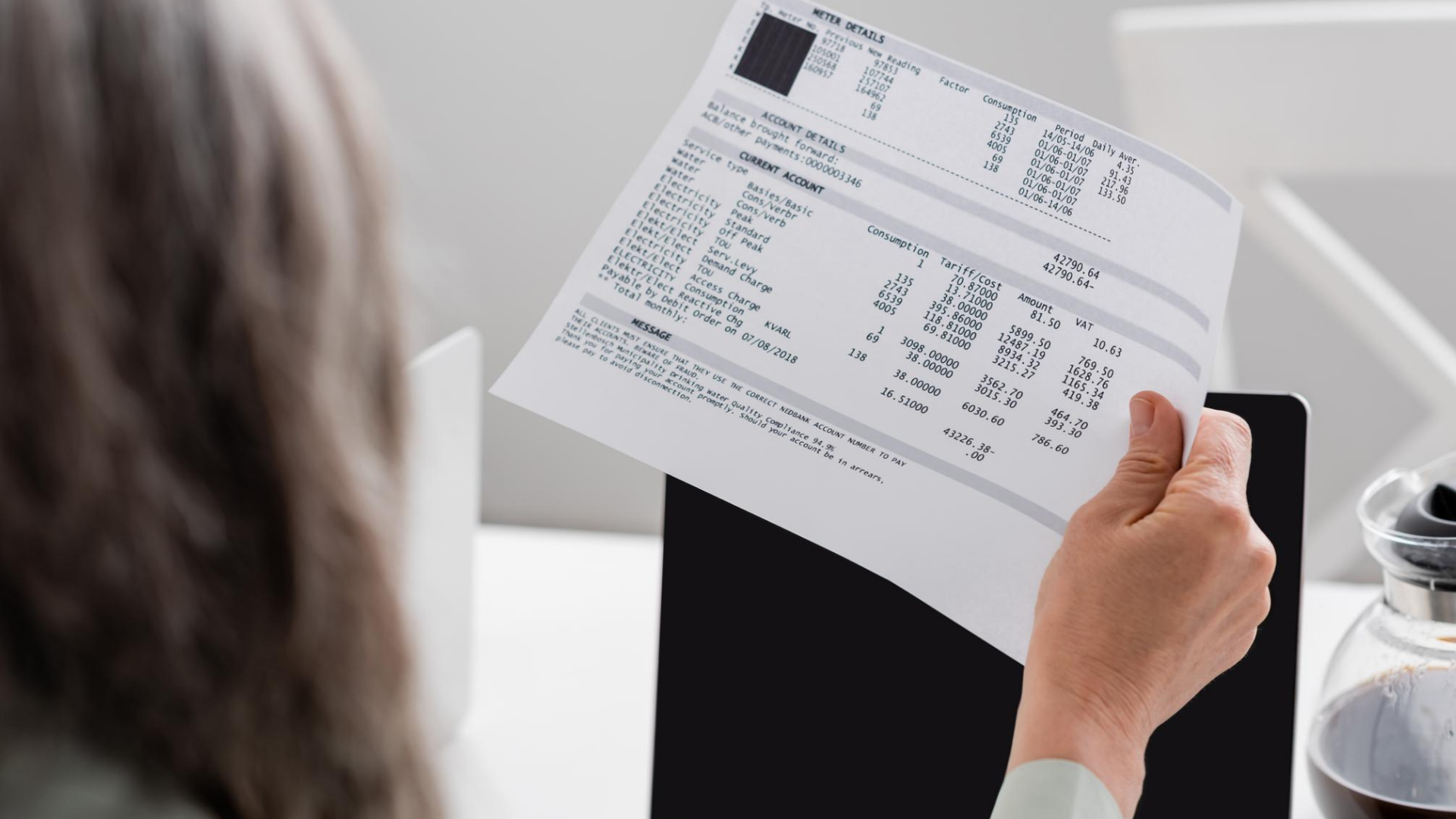

Underestimating or overlooking expenses can quickly derail your budget. Small, irregular expenses often accumulate unnoticed.

Thoroughly track your spending for at least a month. Use budgeting apps or tools to categorize expenses accurately. This detailed analysis will highlight areas where you may be overspending and allow for more realistic budget adjustments.

3. Ignoring Emergency Funds

Unexpected expenses are a part of life, and not accounting for them can disrupt your entire budget.

Prioritize an emergency fund. Set aside a portion of your income to handle unforeseen circumstances. Aim for three to six months' worth of living expenses in your emergency fund to provide a financial safety net.

4. Unrealistic Expectations

Setting overly ambitious saving or debt repayment goals may lead to frustration and budget abandonment.

Establish realistic expectations based on your income, expenses, and financial goals. Incremental progress is still progress. Celebrate small victories to stay motivated and build momentum toward larger financial achievements.

For a more profound grasp of setting budget, head over to our blog Simple Household Budget .

5. Not Accounting for Irregular Expenses

Many budgets overlook irregular but predictable expenses, such as annual insurance premiums or holiday spending.

Identify and plan for irregular expenses. Create sinking funds by setting aside small amounts regularly to cover these periodic costs. This prevents budget shocks and ensures you're prepared when these expenses arise.

6. Failure to Adjust the Budget

Life is dynamic, and a static budget may not accommodate changes in income, expenses, or financial goals.

Regularly review and adjust your budget. Life events like a job change, marriage, or the birth of a child should prompt budget reassessment. Be flexible and willing to modify your budget to reflect your current financial reality.

7. Neglecting Debt Repayment

Ignoring high-interest debt can hinder overall financial progress.

Prioritize debt repayment within your budget. Allocate a portion of your income to tackle outstanding debts systematically. Consider strategies like the debt snowball or avalanche method to efficiently reduce and eliminate debt.

8. Overlooking Personal Enjoyment

A budget that feels too restrictive may lead to frustration and abandonment.

Allocate funds for personal enjoyment. While responsible financial management is crucial, allowing yourself guilt-free spending on hobbies or leisure activities can make your budget sustainable. Find a balance that aligns with your financial goals and personal well-being.

Final Thoughts on Budgeting Success

Embarking on a budgeting journey is a significant step toward financial empowerment. However, the path is rarely linear, and overcoming challenges is an integral part of the process. Recognizing these common stumbling blocks and implementing effective solutions will pave the way for a more resilient and successful budget.

Remember, the goal is not perfection but progress. Each financial decision and adjustment contributes to a stronger foundation for achieving your financial aspirations. By proactively addressing these budgeting hurdles, you are better equipped to navigate the twists and turns of your financial journey. Stay focused, stay adaptable, and celebrate the milestones along the way to financial well-being.