A Practical Guide to Prioritizing Bills and Overcoming Financial Challenges

Table of Contents

Are you grappling with a mountain of unpaid debts and the overwhelming thought, "I can't pay my bills"? The journey to financial recovery may seem insurmountable, especially when income falls short of expenses.

However, there is a way out, and it starts with understanding which bills to prioritize. In this comprehensive guide, we'll unravel the complexities of bill management, providing insights on consequences, prioritization strategies, and steps to regain control of your finances.

Consequences of Unpaid Bills

-

Late Fees and Disconnection The consequences of unpaid bills extend beyond financial strain. Late fees are often the initial repercussions, triggering a cascade of challenges. Service providers, from credit card companies to utility providers, may disconnect services, adding urgency to effective bill management.

-

Credit Score Impact Late payments cast a long shadow on your credit report, with potential repercussions lasting up to seven years. Safeguarding your credit score is crucial for future financial endeavors, making it imperative to address overdue payments strategically.

-

Seizure of Assets and Legal Consequences Secured debts, such as mortgages or car loans, put assets like homes or vehicles at risk of seizure. Legal action, including court proceedings, may follow if creditors cannot recover payments through conventional means.

Prioritizing High-Priority Bills

-

Mortgage or Rent Payments The National Consumer Law Center classifies certain debts as high-priority, emphasizing immediate harm potential. Mortgage or rent payments top this list, as eviction or foreclosure can swiftly follow non-payment.

-

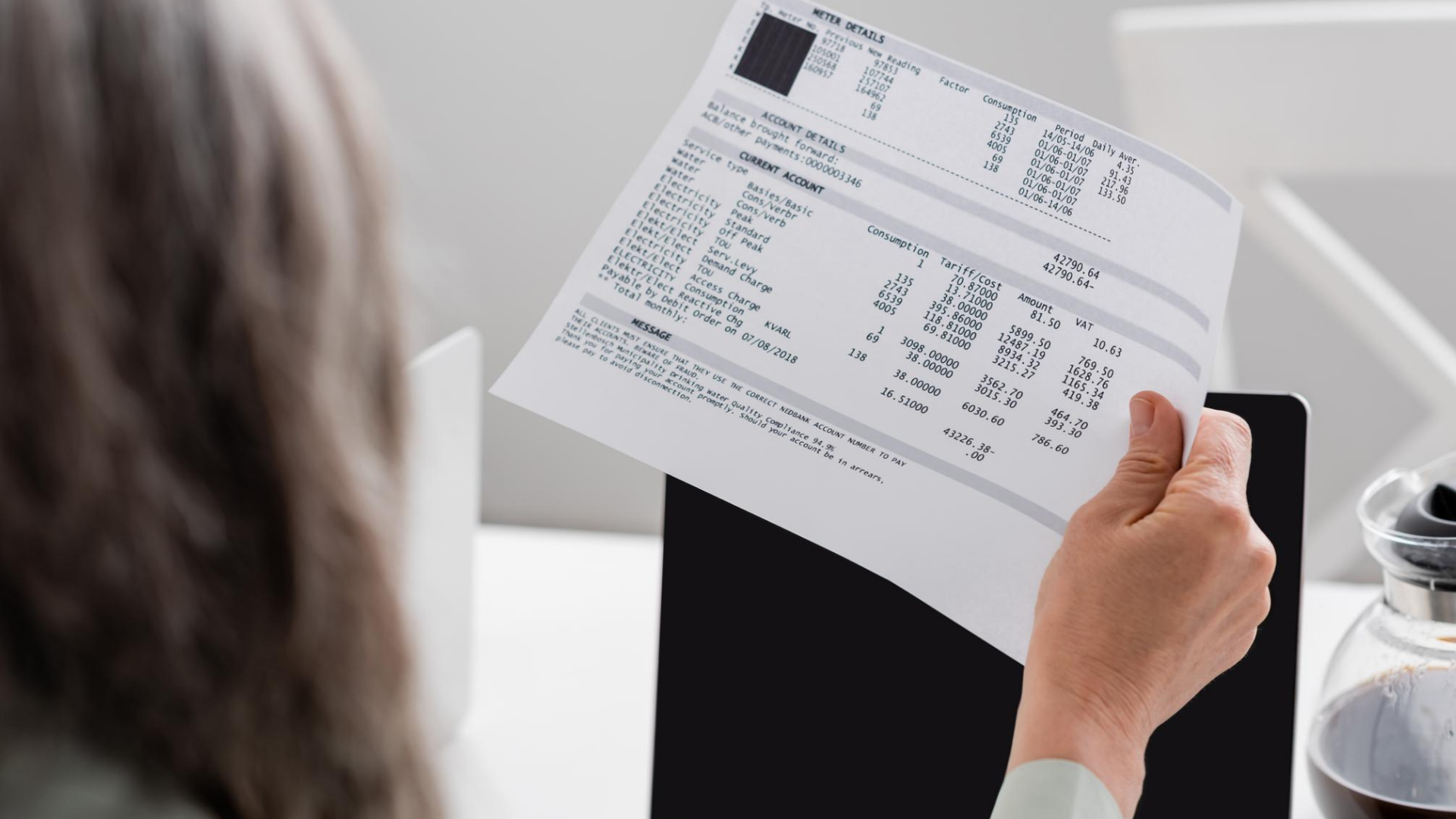

Basic Utilities: Water, Electricity, and Gas Maintaining access to essential utilities is paramount. Disconnection after a single missed payment underscores the urgency of prioritizing water, electricity, and gas bills.

-

Transportation: Auto Loans and Insurance Auto loans and insurance, crucial for daily life, warrant prioritization. Repossession or legal consequences can swiftly unfold after just one or two missed payments.

-

Health Insurance Premiums Protecting health is non-negotiable. Prioritize health insurance premiums to ensure uninterrupted access to medical care. Explore reduced premiums or temporary adjustments in times of financial strain.

Addressing Lower Priority Bills

-

Credit Cards: Mitigating Consequences Credit card payments, while significant, offer more flexibility. Communicate with credit card companies to discuss relief options, such as lower interest rates or deferred payments.

-

Medical Debt: Negotiation and Assistance Late payments on medical debts provide a grace period before affecting credit ratings. Negotiate with healthcare providers, explore payment plans, and leverage assistance programs to manage medical bills strategically.

-

Student Loans: Seeking Flexible Solutions Unsecured student loans provide a buffer, but prolonged neglect can lead to overwhelming debt. Explore deferment, forbearance, or modified repayment plans with lenders to avoid the accumulation of insurmountable student loan debt.

-

Personal Loans and Subscription Services Communication with lenders is crucial for personal loans. For subscription services, reassessment and potential suspension can redirect funds to higher-priority bills.

Taking Immediate Action

-

Prioritize Basic Needs Initiate the process by prioritizing basic needs such as housing, food, utilities, and transportation. Ensuring these essentials are met creates a foundation for effective financial recovery.

-

Build a Realistic Budget Crafting a realistic budget is a powerful tool. Identify income sources, categorize expenses, and set financial goals. A well-defined budget serves as a roadmap to bridge financial gaps.

-

Open Communication with Lenders Engage in open communication with lenders, seeking relief in the form of waived fees, reduced interest rates, or adjusted payment schedules. Proactive communication can prevent credit score damage and legal consequences.

-

Explore Assistance Programs Explore federal, state, and local assistance programs tailored to relieve financial burdens. From emergency rental assistance to energy bill support, various resources can alleviate immediate financial strain.

Building Long-Term Financial Resilience

-

Consistent Progress and Accountability Staying on track requires consistent progress and accountability. Utilize budgeting apps, seek support from trusted individuals, and uphold financial commitments to build a path towards resilience.

-

Professional Guidance: Credit Counseling and Debt Relief Consider credit counseling services for structured repayment plans. Debt settlement, consolidation, or bankruptcy may be viable options, each with its considerations and implications.

-

Continuous Financial Education Continuous financial education empowers individuals to navigate challenges proactively. Seek guidance from reputable organizations, such as the National Foundation for Credit Counseling, and stay informed about available resources.

-

Emergency Funds: A Financial Lifesaver Establishing an emergency fund is vital for weathering life's unexpected storms. Aim to save at least three to six months' worth of living expenses to create a robust financial safety net. This fund acts as a cushion against unforeseen circumstances, preventing reliance on credit cards or loans during challenging times.

-

Contingency Planning Contingency planning is a proactive strategy for financial stability. Anticipate potential challenges such as income reduction or unexpected expenses. Integrate contingency plans into your comprehensive budget framework to identify areas for resource reallocation during unforeseen financial strains, ensuring a resilient financial future.

Delve deeper into effective contingency planning by checking out our extensive blog on Navigating Financial Uncertainties.

-

Creating a Budget Framework Your budget is the cornerstone of financial stability, offering a roadmap for income, expenses, and savings. Systematically categorize income sources and differentiate between fixed and variable costs. Fixed costs, like rent and utilities, are prioritized, followed by discretionary spending.

-

Allocating Resources Wisely Once categorized, allocate resources based on priority. Prioritize essential bills to meet basic needs, then allocate funds for debt repayment, savings, and discretionary spending. A well-structured budget framework empowers informed financial decisions, prevents unnecessary debt, and steers you towards both short-term and long-term financial goals.

For more insights and detailed tips, visit our website's comprehensive guide on creating household Budget for Financial Success.

Conclusion

Navigating financial challenges demands a strategic, informed approach. By prioritizing bills, communicating with creditors, and exploring assistance programs, individuals can regain control. Proactive steps, combined with continuous financial education, pave the way for long-term resilience. As you embark on this journey, remember that regaining control is a gradual process, and each informed decision contributes to a more secure financial future.

** Note: The information provided in this guide is for educational purposes only and should not be considered as financial advice. It is recommended to consult with a financial advisor for personalized guidance.